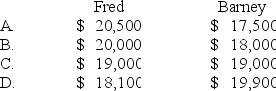

Fred and Barney started a partnership. Fred invested $20,000 in the business and Barney invested $32,000. The partnership agreement stipulated that profits would be divided as follows: Each partner would receive a 15% return on invested capital with the remaining income being distributed equally between the two partners. Assuming that the partnership earned $38,000 during an accounting period, the amount of income assigned to the two partners would be:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q19: On January 2, Year 1, Torres Corporation

Q39: Which of the following entities would have

Q46: Which of the following is not normally

Q48: Flagler Corporation shows a total of $660,000

Q49: Which of the following statements about types

Q50: Which of the following entities would report

Q55: Ix Company issued 20,000 shares of $20

Q58: Blair Scott started a sole proprietorship by

Q59: At the end of the accounting period,

Q60: The term "Retained Earnings" is best explained

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents