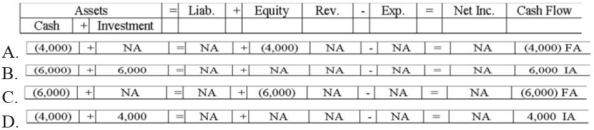

Kellogg, Inc. purchased 200 shares of its own $20 par value stock for $30 cash per share. Which of the following answers reflects how this purchase of treasury stock would affect Kellogg's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q23: On March 1, Year 1, Gilmore Incorporated

Q26: Chandler Company declared and paid a cash

Q27: Vailes Company reissued 200 shares of its

Q30: What effect will the declaration and distribution

Q46: Which of the following is not normally

Q48: Flagler Corporation shows a total of $660,000

Q59: At the end of the accounting period,

Q61: The issuance of a stock dividend will

A)decrease

Q70: For Year 1, the Sacramento Corporation had

Q72: Montana Company was authorized to issue 200,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents