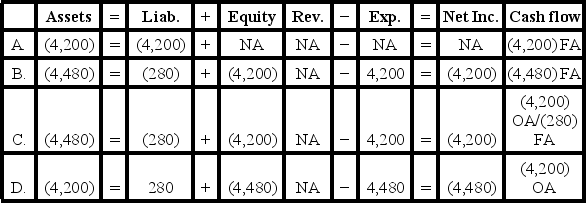

The Gordon Corporation issued $70,000 of 6%, 5-year bonds on January 1, Year 1 at 98. The interest payments are due on December 31 each year. Gordon uses the straight-line method of amortization. Which of the following answers shows the effect of the first interest payment and amortization of premium or discount?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q42: The Gordon Corporation issued $70,000 of 6%,

Q48: Johansen Company issued a bond at a

Q54: Pace Company issued at 97 bonds with

Q91: Denver Co.issued bonds with a face value

Q98: Issuing bonds payable when the market rate

Q105: Eureka Company issued $100,000 in bonds payable

Q111: Jones Company issued bonds with a $200,000

Q112: On January 1, Year 1, The Hanover

Q116: Jones Company issued bonds with a $200,000

Q119: Jones Company issued bonds with a $200,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents