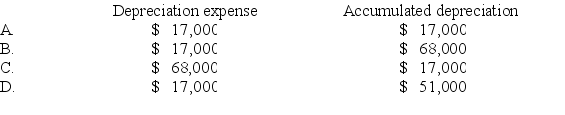

Emir Company purchased equipment that cost $110,000 cash on January 1, Year 1. The equipment had an expected useful life of six years and an estimated salvage value of $8,000. Assuming that Emir depreciates its assets under the straight-line method, the amount of depreciation expense appearing on the Year 4 income statement and the amount of accumulated depreciation appearing on the December 31, Year 4, balance sheet would be:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q28: Dinkins Company purchased a truck that cost

Q35: Chubb Company paid cash to purchase equipment

Q38: On January 1, Year 1, Friedman Company

Q40: On January 1, Year 1, Dinwiddie Company

Q41: On January 1, Year 1, the Vanguard

Q44: Good Company paid cash to purchase mineral

Q56: Goodwill may be recorded in which of

Q66: Madison Company owned an asset that had

Q71: On January 1, Year 1, the City

Q89: The recognition of depletion expense

A)decreases assets and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents