Use the following information to answer the question(s) below.

d'Anconia Copper has $200 million in cash that it can use for a share repurchase. Suppose instead that d'Anconia Copper invests the funds in an account paying 5% interest for one year. Assume that the corporate tax rate is 35%, the individual capital gains rate is 15% and the individual rate on ordinary income is 30%.

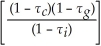

-Consider the following equation: Pretain = Pcum ×  The term Pretain in this equation represents:

The term Pretain in this equation represents:

A) the price of the stock if it retains and invests the cash.

B) the percentage of net income retained or reinvested back into the firm.

C) the percentage of net income paid out as a cash dividend.

D) the price of the stock if it retains cash to use in a share repurchase.

Correct Answer:

Verified

Q61: In 2006,Luther Incorporated paid a special dividend

Q62: The effective tax disadvantage for retaining cash

Q63: Suppose that d'Anconia Copper retained the $200

Q64: Which of the following statements is FALSE?

A)A

Q72: Use the information for the question(s)below.

Luther Industries

Q73: Use the following information to answer the

Q74: Use the information for the question(s)below.

Iota Industries

Q79: Use the information for the question(s)below.

Consider the

Q80: Use the information for the question(s)below.

Iota Industries

Q91: Use the information for the question(s)below.

Luther Industries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents