Use the following information to answer the question(s) below.

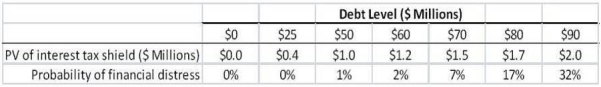

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

A) $50 million.

B) $60 million.

C) $70 million.

D) $80 million.

Correct Answer:

Verified

Q47: Use the information for the question(s)below.

Big Blue

Q48: Which of the following statements is FALSE?

A)The

Q49: Which of the following industries is likely

Q50: Which of the following industries is likely

Q51: Which of the following statements is FALSE?

A)Real

Q53: Use the following information to answer the

Q54: Use the information for the question(s)below.

Luther Industries

Q55: Which of the following statements is FALSE?

A)The

Q56: Use the following information to answer the

Q57: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents