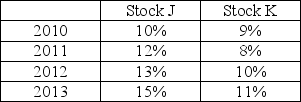

Given the returns of two stocks J and K in the table below over the next 4 years. Find the expected return and standard deviation of holding a portfolio of 40% of stock J and 60% in stock K over the next 4 years:

A) 10.6% and 1.34%

B) 10.6% and 1.79%

C) 10.6% and 1.16%

D) 14.3% and 2.02%

Correct Answer:

Verified

Q83: Table 8.1 Q84: A portfolio of two negatively correlated assets Q85: Combining uncorrelated assets can reduce risk-not as Q86: A portfolio combining two assets with less Q90: Over long periods, returns from internationally diversified Q90: A portfolio combining two assets whose returns Q92: Akai has a portfolio of three assets.![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents