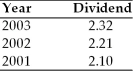

China America Manufacturing has a beta of 1.50, the risk-free rate of interest is currently 12 percent, and the required return on the market portfolio is 18 percent. The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate consistent with that experienced over the 2001-2003 period.  Estimate the value of China America Manufacturing's stock.

Estimate the value of China America Manufacturing's stock.

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: In valuation of common stock, the price/earnings

Q147: The free cash flow valuation model is

Q155: Colin recently purchased a block of 100

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents