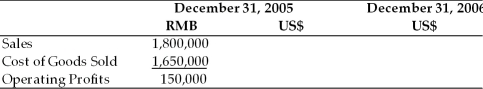

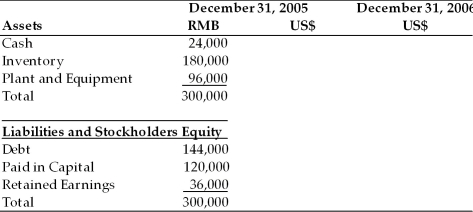

A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2005, the exchange rate was 8.27 RMB/US$. Assume the local currency figures in the statement below remain the same on December 31, 2006. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2005 and December 31, 2006, the Chinese government revalues (appreciates) the RMB by 20 percent.

Translation of Income Statement  Translation of Balance Sheet

Translation of Balance Sheet

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: When more units of a foreign currency

Q43: All of the following are considered to

Q44: Both theory and empirical evidence indicate that

Q45: Micro political risk is the risk faced

Q45: The spot exchange rate is the rate

Q46: Although several economic and political factors can

Q47: Countries that experience high inflation rates will

Q51: Recent years have seen the emergence of

Q52: The forward exchange rate is the rate

Q52: The three basic types of risk associated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents