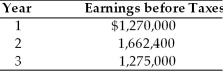

Hayley Medical, Inc. is evaluating the acquisition of Health-o-Matic, Inc., which had a loss carryforward of $3.75 million, resulting from earlier operations. Hayley Medical can purchase Health-o-Matic for $4.5 million and liquidate the assets for $3.25 million. Hayley Medical expects earnings before taxes in the three years following the acquisition to be as follows:  (These earnings are assumed to fall within the annual limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Hayley Medical has a 40 percent tax rate and a cost of capital of 15 percent. The approximate maximum cash price Hayley Medical would be willing to pay for Health-o-Matic is

(These earnings are assumed to fall within the annual limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Hayley Medical has a 40 percent tax rate and a cost of capital of 15 percent. The approximate maximum cash price Hayley Medical would be willing to pay for Health-o-Matic is

A) $4,750,000.

B) $4,500,000.

C) $4,410,000.

D) $3,750,000.

Correct Answer:

Verified

Q126: A two-tier offer is a tender offer

Q128: If the P/E paid for a target

Q128: Tangshan Mining is attempting to acquire Zhengsen

Q130: Greenmail is a takeover defense under which

Q132: If the P/E paid is less than

Q134: Tangshan Mining is considering the acquisition of

Q136: Tangshan Mining is attempting to acquire Zhengsen

Q137: The overriding goal for merging is to

A)

Q140: A white knight is a takeover defense

Q149: A major disadvantage of holding companies is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents