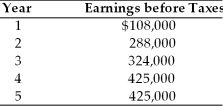

Jia's Oven Manufacturing is evaluating the acquisition of Cuisinaire Kitchen Appliance Co. Cuisinaire has a loss carryforward of $1.5 million which resulted from earlier operations. Jia's Oven can purchase Cuisinaire for $1.8 million and liquidate the assets for $1.3 million. Jia's Oven expects earnings before taxes in the five years following the acquisition to be as follows:  (These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed acquisition.) Jia's Oven is in the 40 percent tax bracket and has a cost of capital of 17 percent.

(These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed acquisition.) Jia's Oven is in the 40 percent tax bracket and has a cost of capital of 17 percent.

(a) What is the tax advantage of the acquisition each year for Jia's Oven?

(b) What is the maximum cash price Jia's Oven would be willing to pay for Cuisinaire?

(c) Do you recommend the acquisition? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: A two-tier offer is a tender offer

Q134: Tangshan Mining is considering the acquisition of

Q136: Tangshan Mining is attempting to acquire Zhengsen

Q137: The overriding goal for merging is to

A)

Q140: A white knight is a takeover defense

Q140: A poison pill is a takeover defense

Q141: All of the following are disadvantages of

Q142: A formal proposal to purchase a given

Q143: The U.S. approaches used in hostile takeovers

Q144: Popular takeover defense methods include white knights,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents