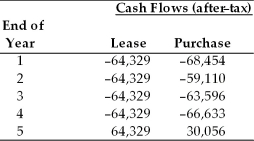

Bessey Aviation is considering leasing or purchasing a small aircraft to transport executives between manufacturing facilities and the main administrative headquarters. The firm is in the 40 percent tax bracket and its after-tax cost of debt is 7 percent. The estimated after-tax cash flows for the lease and purchase alternatives are given below:  (a) Given the above cash outflows for each alternative, calculate the present value of the after-tax cash flows using the after-tax cost of debt for each alternative.

(a) Given the above cash outflows for each alternative, calculate the present value of the after-tax cash flows using the after-tax cost of debt for each alternative.

(b) Which alternative do you recommend? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: The conversion ratio is the ratio at

Q43: Disadvantages of leasing from the lessee's perspective

Q43: The consequences of missing a financial lease

Q45: All of the following must be considered

Q46: Dwyer Corporation is determining whether to lease

Q48: The total payments of _ lease over

Q49: Advantages of leasing from the lessee's perspective

Q50: _ leases are noncancelable and are generally

Q51: A noncancelable arrangement that requires the lessee

Q52: In a _, the lessor acts as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents