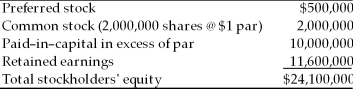

Hayley's Optical has a stockholders' equity account as shown below. The firm's common stock currently sells for $20 per share.  (a) What is the maximum dividend per share Hayley's Optical can pay? (Assume capital includes all paid-in capital.)

(a) What is the maximum dividend per share Hayley's Optical can pay? (Assume capital includes all paid-in capital.)

(b) Recast the partial balance sheet (the stockholders' equity accounts) to show independently

(1) a 2 for 1 stock split of the common stock.

(2) a cash dividend of $1.50 per share.

(3) a stock dividend of 5% on the common stock.

(c) At what price would you expect Hayley's Optical stock to sell after

(1) the stock split?

(2) the stock dividend?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: The "treasury stock" is an accounting entry

Q120: The purpose of a stock split is

Q120: The shareholder receiving a stock dividend receives

Q121: When purchasing outstanding shares of common stock

Q122: The primary purpose of a stock split

Q124: The net effect of a stock repurchase

Q125: Enhancement of shareholder value through stock repurchase

Q126: Stock repurchases may be made for all

Q127: The repurchase of stock _ the earnings

Q128: Tangshan Mining Company has released the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents