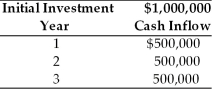

Table 12.2

A firm is considering investment in a capital project which is described below. The firm's cost of capital is 18 percent and the risk-free rate is 6 percent. The project has a risk index of 1.5. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-It has been found that the value of the stock of corporations whose shares are traded publicly in an efficient marketplace is

A) generally positively affected by diversification, because of the reduction in risk.

B) generally negatively affected by diversification, because of the increase in risk.

C) generally not affected by diversification, unless greater returns are expected.

D) generally negatively affected by diversification, because of the increase in the required rate of return.

Correct Answer:

Verified

Q65: The theoretical basis from which the concept

Q66: The preferred approach for risk adjustment of

Q66: Table 12.2

A firm is considering investment in

Q67: Table 12.3

Tangshan Mining Company is considering investment

Q69: Table 12.3

Tangshan Mining Company is considering investment

Q69: Table 12.4

Johnson Farm Implement is faced with

Q70: The _ reflects the return that must

Q76: Table 12.4

Johnson Farm Implement is faced with

Q76: In case of unequal-lived, mutually exclusive projects,

Q77: Table 12.5

Nico Manufacturing is considering investment in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents