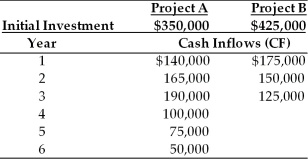

Table 12.6

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-The Annualized NPV of project B is ________. (See Table 12.6)

A) $11,673

B) $12,947

C) $38,227

D) $21,828

Correct Answer:

Verified

Q81: The _ approach is used to convert

Q86: Table 12.6

Yong Importers, an Asian import company,

Q88: A firm is evaluating two mutually exclusive

Q88: When unequal-lived projects are independent, the impact

Q89: Real options are opportunities that are embedded

Q91: The risk-adjusted discount rate approach to evaluating

Q92: As a top manager, you must decide

Q94: In selecting the best group of unequal-lived

Q96: A firm with unlimited funds must evaluate

Q99: The objective of capital rationing is to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents