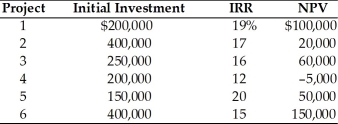

Table 10.4

A firm must choose from six capital budgeting proposals outlined below. The firm is subject to capital rationing and has a capital budget of $1,000,000; the firm's cost of capital is 15 percent.

-Using the internal rate of return approach to ranking projects, which project(s) should the firm accept? (See Table 10.4)

A) 1, 2, 3, 4, and 5

B) 1, 2, 3, and 5

C) 2, 3, 4, and 6

D) 1, 3, 4, and 6

Correct Answer:

Verified

Q153: Table 10.4

A firm must choose from six

Q154: When evaluating projects using NPV approach, _.

A)

Q155: On a purely theoretical basis, IRR is

Q156: Table 10.3

A firm is evaluating two projects

Q157: Unlike the net present value criteria, the

Q159: A firm with a cost of capital

Q160: The internal rate of return assumes that

Q161: In comparing the internal rate of return

Q162: Table 10.5

Galaxy Satellite Co. is attempting to

Q163: Which of the following is a reason

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents