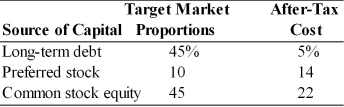

A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target market value proportions:  If the firm were to shift toward a more leveraged capital structure (i.e., a greater percentage of debt in the capital structure) , the weighted average cost of capital would

If the firm were to shift toward a more leveraged capital structure (i.e., a greater percentage of debt in the capital structure) , the weighted average cost of capital would

A) increase.

B) remain unchanged.

C) decrease.

D) not be able to be determined.

Correct Answer:

Verified

Q105: When discussing weighing schemes for calculating the

Q106: Since retained earnings is a more expensive

Q107: A firm has determined its cost of

Q110: Target weights are either book value or

Q112: The weighted average cost of capital (WACC)

Q114: Generally, the order of cost, from the

Q114: In computing the weighted average cost of

Q115: The weighted average cost that reflects the

Q119: In computing the weighted average cost of

Q120: As the volume of financing increases, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents