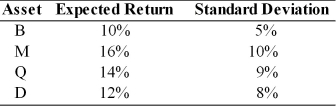

Given the following expected returns and standard deviations of assets B, M, Q, and D, which asset should the prudent financial manager select?

A) Asset B

B) Asset M

C) Asset Q

D) Asset D

Correct Answer:

Verified

Q26: On average, during the past 75 years,

Q28: The real utility of the coefficient of

Q33: The larger the difference between an asset's

Q34: The risk of an asset can be

Q41: A common approach of estimating the variability

Q44: The _ of an event occurring is

Q45: The higher the coefficient of variation, the

Q45: The expected value, standard deviation of returns,

Q50: The lower the coefficient of variation, the

Q86: The _ the coefficient of variation, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents