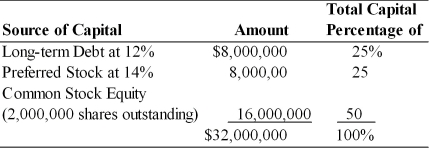

Zheng Sen's Chinese Take-Out had earnings before interest and taxes of $4,000,000 last year. The firm has a marginal tax rate of 40 percent and currently has the following capital structure:  (a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(b) If the firm retires $4,000,000 of preferred stock using the proceeds from an equal increase in long-term debt, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

(c) If the firm retires $4,000,000 of preferred stock using the proceeds from the sale of 500,000 shares of common stock, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: If the expected return is less than

Q106: In an efficient market, the expected return

Q113: Investors purchase a stock when they believe

Q115: A group formed by an investment banker

Q118: The constant growth model is an approach

Q126: A firm has an expected dividend next

Q127: A firm has experienced a constant annual

Q134: Preferred stock is valued as if it

Q134: A firm has an issue of preferred

Q137: Nico Corporation's common stock currently sells for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents