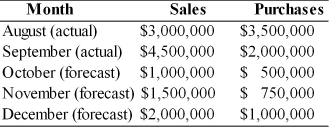

In preparation for the quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate a cash budget for the months of October, November, and December based on the information shown below.  ∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

∙ Interest income of $50,000 on marketable securities will be received in December.

∙ The firm pays cash for 40 percent of its purchases.

∙ The firm pays for 60 percent of its purchases the following month.

∙ Salaries and wages amount to 15 percent of the preceding month's sales.

∙ Sales commissions amount to 2 percent of the preceding month's sales.

∙ Lease payments of $100,000 must be made each month.

∙ A principal and interest payment on an outstanding loan is due in December of $150,000.

∙ The firm pays dividends of $50,000 at the end of the quarter.

∙ Fixed assets costing $600,000 will be purchased in December.

∙ Depreciation expense each month of $45,000.

∙ The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: Due to the no fixed costs assumption

Q129: A firm has actual sales in November

Q131: The strict application of the percent-of-sales method

Q132: A firm has actual sales in November

Q134: Harry's House of Hamburgers (HHH) wants to

Q136: All of the following are ways to

Q137: Because the typical cash budget shows cash

Q139: In the month of August, a firm

Q148: Under the judgmental approach for developing a

Q178: The _ method of developing a pro

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents