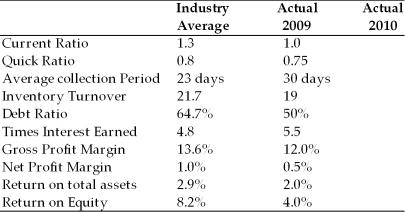

Table 3.2

Dana Dairy Products Key Ratios  Income Statement

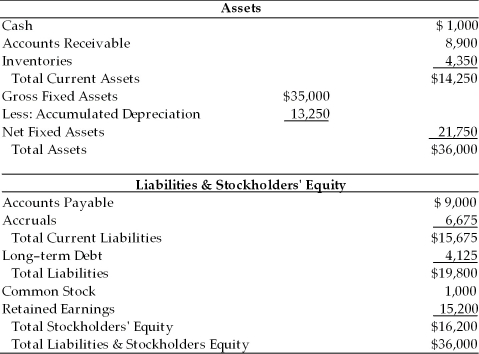

Income Statement

Dana Dairy Products

For the Year Ended December 31, 2010  Balance Sheet

Balance Sheet

Dana Dairy Products

December 31, 2010

-Using the modified DuPont formula allows the analyst to break Dana Dairy Products return on equity into 3 components: the net profit margin, the total asset turnover, and a measure of leverage (the financial leverage multiplier) . Which of the following mathematical expressions represents the modified DuPont formula relative to Dana Dairy Products' 2010 performance? (See Table 3.2)

A) 5.6(ROE) = 2.5(ROA) × 2.24(Financial leverage multiplier)

B) 5.6(ROE) = 3.3(ROA) × 1.70(Financial leverage multiplier)

C) 4.0(ROE) = 2.0(ROA) × 2.00(Financial leverage multiplier)

D) 2.5(ROE) = 5.6(ROA) × 0.44(Financial leverage multiplier)

Correct Answer:

Verified

Q151: Using the DuPont system of analysis and

Q199: Table 3.2

Dana Dairy Products Key Ratios

Q201: Table 3.2

Dana Dairy Products Key Ratios

Q203: Table 3.2

Dana Dairy Products Key Ratios

Q203: As the financial leverage multiplier increases, this

Q205: Complete the balance sheet for General Aviation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents