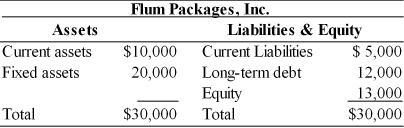

Table 14.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $2,000 of current liabilities to long-term funds, the firm's net working capital would ________, the annual cost of financing would ________, and the risk of technical insolvency would ________, respectively. (See Table 14.2)

A) decrease; decrease; increase

B) increase; increase; decrease

C) decrease; increase; decrease

D) increase; decrease; decrease

Correct Answer:

Verified

Q103: The difference between the number of days

Q105: The conservative financing strategy results in financing

Q108: In economic conditions characterized by a scarcity

Q112: The aggressive financing strategy is _ method

Q113: The Hedge Company has an average age

Q116: Ideally a firm would like to have

Q118: A decrease in the production time to

Q119: A firm has annual operating outlays of

Q120: Table 14.2 Q126: In the ABC system of inventory management,![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents