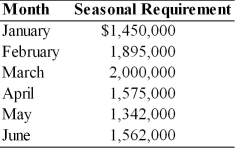

Studio San, a dealer in contemporary art, has forecasted its seasonal financing needs for the next six months as follows:  (a) The firm projects short-term funds will cost 11 percent and long-term funds will cost 13 percent annually.

(a) The firm projects short-term funds will cost 11 percent and long-term funds will cost 13 percent annually.

(b) The firm's permanent funds requirement is $500,000.

Calculate financing costs for the first six months using the aggressive and conservative strategies.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: In economic conditions characterized by a scarcity

Q118: A decrease in the production time to

Q119: A firm has annual operating outlays of

Q120: Table 14.2 Q124: A firm which uses the aggressive financing Q126: In the ABC system of inventory management, Q126: Adam's Aeronautics is interested in making sure Q133: A firm with a cash conversion cycle Q135: Table 14.3 Q140: A firm may have a negative cash![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents