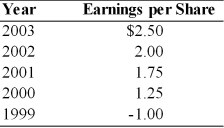

A firm has had the following earnings history over the last five years:  If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the years with earnings over $1.50 per share and a zero payout otherwise, the annual dividends for 1999 and 2003 were

If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the years with earnings over $1.50 per share and a zero payout otherwise, the annual dividends for 1999 and 2003 were

A) $0.50 and $1.25, respectively.

B) $0 and $2.00, respectively.

C) $0 and $1.25, respectively.

D) $0 and $0.88, respectively.

Correct Answer:

Verified

Q61: The dividend policy must be formulated considering

Q64: The capital impairment restrictions are established to

A)

Q65: The level of dividends a firm expects

Q71: An excess earnings accumulation tax is levied

Q72: If a firm has overdue liabilities or

Q81: Which type of dividend payment policy has

Q83: When a firm pays a stated dollar

Q85: A firm has had the indicated earnings

Q87: A firm has current after-tax earnings of

Q92: The problem with the regular dividend policy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents