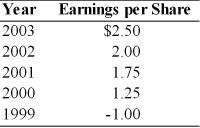

A firm has had the following earnings history over the last five years:  If the firm's dividend policy was to pay $0.25 per share each period except when earnings exceed $1.50, when an extra dividend equal to 50 percent of the earnings above $1.50 would be paid, the annual dividends for 2000 and 2003 were

If the firm's dividend policy was to pay $0.25 per share each period except when earnings exceed $1.50, when an extra dividend equal to 50 percent of the earnings above $1.50 would be paid, the annual dividends for 2000 and 2003 were

A) $0.25 and $1.25, respectively.

B) $0.25 and $0.75, respectively.

C) $0 and $0.25, respectively.

D) $0.25 and $0.25, respectively.

Correct Answer:

Verified

Q82: In case of stock dividend, the shareholder's

Q85: The payment of a stock dividend is

Q95: If the firm's earnings remain constant and

Q96: After the stock dividend is paid, the

Q97: A firm has had the following earnings

Q98: The advantage of using the low-regular-and-extra dividend

Q99: The problem with a constant-payout-ratio dividend policy

Q103: In a 2-for-1 stock split, the number

Q104: A shareholder receiving a stock dividend typically

Q120: The purpose of a stock split is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents