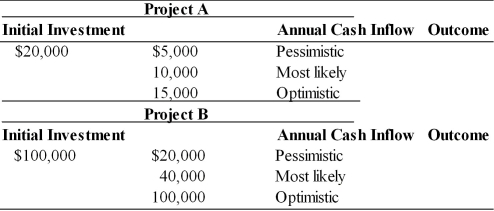

Table 11.7

A corporation is assessing the risk of two capital budgeting proposals. The financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows which are given in the following table. The firm's cost of capital is 10 percent.

-The expected net present value of project A if the outcomes are equally probable and the project has five-year life is ________. (See Table 11.7)

A) -$1,045

B) $17,910

C) $36,865

D) $93,730

Correct Answer:

Verified

Q2: Scenario analysis is a behavioral approach that

Q26: Tangshan Mining Company, with a cost of

Q36: One type of simulation program made popular

Q40: Behavioral approaches for dealing with project risk

A)

Q50: Risk-adjusted discount rates (RADRs) are the risk-adjustment

Q52: The risk-adjusted discount rate is the rate

Q60: The risk-adjusted discount rate (RADR) is the

Q91: The risk-adjusted discount rate (RADR) is the

Q128: Breakeven cash inflow refers to

A) the minimum

Q137: Table 11.7

A corporation is assessing the risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents