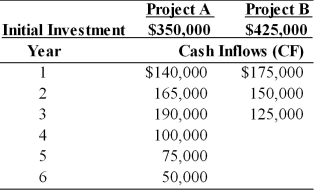

Table 11.12

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-The NPVs of projects A and B are ________. (See Table 11.12)

A) $95,066 and $56,386, respectively

B) $56,386 and $95,066, respectively

C) -$56,386 and -$95,066, respectively

D) none of the above

Correct Answer:

Verified

Q44: Despite their focus on total risk, RADRs

Q63: When unequal-lived projects are independent, the length

Q65: The theoretical basis from which the concept

Q66: The preferred approach for risk adjustment of

Q81: The _ approach is used to convert

Q98: In selecting the best group of unequal-lived

Q159: Table 11.8

A firm is considering investment in

Q160: Table 11.9

Tangshan Mining Company is considering investment

Q164: Table 11.12

Yong Importers, an Asian import company,

Q165: Table 11.10

Johnson Farm Implement is faced with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents