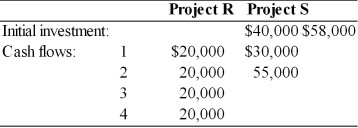

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows:

A) Choose Project R because its ANPV is $6460.

B) Choose Project S because its ANPV is $6460.

C) Choose Project R because its ANPV is $18,274.

D) Choose Project S because its ANPV is $10637.

Correct Answer:

Verified

Q89: Real options are opportunities that are embedded

Q98: Adjusted net present values are opportunities that

Q99: The objective of capital rationing is to

Q103: An approach to capital rationing that involves

Q104: Major types of real options include all

Q105: The ordering of capital expenditure projects on

Q106: If a firm has a limited capital

Q191: A firm is evaluating two mutually exclusive

Q193: A firm with unlimited funds must evaluate

Q195: As a top manager, you must decide

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents