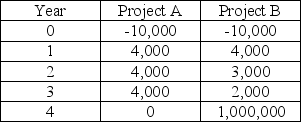

Evaluate the following projects using the payback method assuming a rule of 3 years for payback.

A) Project A can be accepted because the payback period is 2.5 years but Project B cannot be accepted because its payback period is longer than 3 years.

B) Project B should be accepted because even thought the payback period is 2.5 years for project A and 3.001 project B, there is a $1,000,000 payoff in the 4th year in Project B.

C) Project B should be accepted because you get more money paid back in the long run.

D) Both projects can be accepted because the payback is less than 3 years.

Correct Answer:

Verified

Q67: A firm is evaluating a proposal which

Q81: If the NPV is greater than $0.00,

Q89: If the NPV is greater than the

Q89: Net present value is considered a sophisticated

Q90: The NPV of an project with an

Q90: The NPV of an project with an

Q92: A sophisticated capital budgeting technique that can

Q94: Which of the following statements is false?

A)

Q100: The discount rate (which is also known

Q117: Table 10.1 ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents