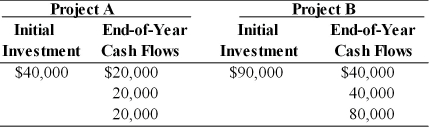

Table 10.4

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows:

-The new financial analyst does not like the payback approach (Table 10.4) and determines that the firm's required rate of return is 15 percent. His recommendation would be to

A) accept projects A and B.

B) accept project A and reject B.

C) reject project A and accept B.

D) reject both.

Correct Answer:

Verified

Q115: The _ is the discount rate that

Q122: The IRR method assumes the cash flows

Q123: On a purely theoretical basis, NPV is

Q134: Since the cost of capital tends to

Q141: A firm with a cost of capital

Q143: In spite of the theoretical superiority of

Q148: On a purely theoretical basis, NPV is

Q149: Comparing net present value and internal rate

Q155: On a purely theoretical basis, IRR is

Q161: In comparing the internal rate of return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents