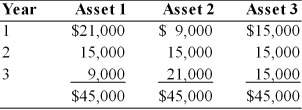

A financial manager must choose between three alternative investments. Each asset is expected to provide earnings over a three-year period as described below. Based on the wealth maximization goal, the financial manager would

A) choose Asset 1.

B) choose Asset 2.

C) choose Asset 3.

D) be indifferent between Asset 1 and Asset 2.

Correct Answer:

Verified

Q22: The profit maximization goal ignores the timing

Q34: The wealth of corporate owners is measured

Q41: Risk and the magnitude and timing of

Q51: An increase in firm risk tends to

Q55: Wealth maximization as the goal of the

Q61: The financial manager places primary emphasis on

Q67: Cash flow and risk are the key

Q71: The financial manager prepares financial statements that

Q77: Corporate ethics policies typically apply to _

Q79: An ethics program is expected to have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents