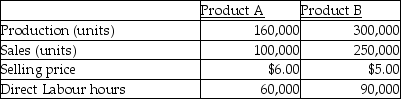

The following information refers to the Cowan Company's past year of operations.

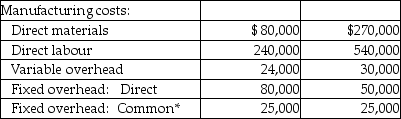

*Common overhead totals $50,000 and is divided equally between the two products.

*Common overhead totals $50,000 and is divided equally between the two products.

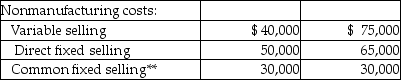

**Common fixed selling totals $60,000 and is divided equally between the two products.

Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plant-wide rate based on expected direct labour hours, which were 150,000. The company had 5,000 of Product B in inventory at the beginning of the year. These units had the same unit cost as the units produced during the year.

-The unit product cost for Product B using absorption costing is

A) $3.16.

B) $2.80.

C) $2.60.

D) $2.45.

Correct Answer:

Verified

Q88: Under variable costing, which manufacturing cost is

Q90: In variable costing, revenue less all variable

Q91: DeJager Company reported the following information about

Q92: The following information refers to the Cowan

Q94: In variable costing, costs are separated into

Q95: Schultz Company reported the following information about

Q96: DeJager Company reported the following information about

Q97: A company has the following information:

Q98: The following information refers to the Cowan

Q126: The fixed-overhead rate is determined by dividing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents