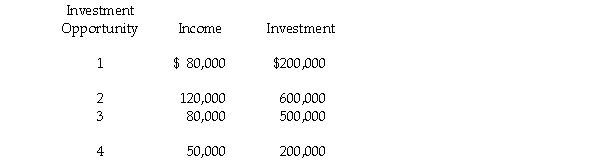

Raymer Incorporated has just formed a new division and the following four investment opportunities are available to the division. The firm requires a minimum return of 20 percent.  a. If you were the division manager and your evaluation was based on ROI, which investment opportunities would you accept?

a. If you were the division manager and your evaluation was based on ROI, which investment opportunities would you accept?

b. If your evaluation was based on RI, which investment opportunities would you accept?

c. If you were president, which projects would you want the division to accept and which performance measure would you use to encourage this action?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: What a firm must pay to acquire

Q93: Inman Company has two fabric divisions, Cotton

Q95: A theory used to describe the formal

Q96: Any action taken in conflict with organizational

Q97: Those formal and informal performance-based rewards that

Q98: The Middleton Division of TTR Enterprises expects

Q99: The following information is available for the

Q102: Crickmore Industries has two divisions, the D

Q103: Stirton Industries is a decentralized company that

Q169: The original cost of an asset less

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents