Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

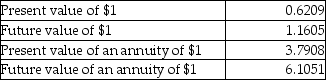

Time value factors are given below for 5 years and an interest rate of 10 percent.

-What is the net present value of the tax savings from depreciation?

A) $3,912

B) $23,881

C) $10,235

D) $1,677

Correct Answer:

Verified

Q47: Which of the following is NOT usually

Q48: When making capital-budgeting decisions, the effects of

Q49: A company is considering the purchase of

Q50: A company with pretax income of $60,000

Q51: In making capital-budgeting decisions, it is relevant

Q53: Fagen Grocery Store is considering the purchase

Q54: The cash inflow effect of a disposal

Q55: Another term for market interest rate is

A)

Q56: The "inflation element" refers to the

A) future

Q57: Which of the following statements about depreciation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents