The owner of a construction company is contemplating possible purchase of new equipment. The equipment would cost $40,000, have an expected life of 8 years and a zero terminal salvage value. The equipment is Class 8 (20% declining balance).

The equipment would generate $125,000 of additional annual revenue, but yearly expenses for additional labour and material would also increase by $115,000.

Assume the appropriate tax rate is 20 percent. The required after-tax rate of return is 14 percent.

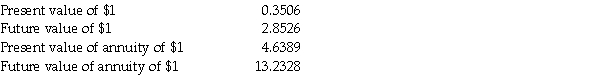

The following data are for an interest rate of 14 percent and 8 periods.  Required: Compute the net present value of the investment. Should the equipment be purchased?

Required: Compute the net present value of the investment. Should the equipment be purchased?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: A tax rule that assumes a newly

Q100: Allowable depreciation under the income tax act

Q101: The Serena Company is evaluating two mutually

Q102: The annual income statement of ZAP Inc.

Q103: Cedric Inc. is considering two mutually exclusive

Q105: Lawton Co. is evaluating a project that

Q106: WN Company manufactures high quality Wagnuts. It

Q108: Depreciation deductions and similar deductions that protect

Q109: Boric Company is considering the purchase of

Q150: The decline in the general purchasing power

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents