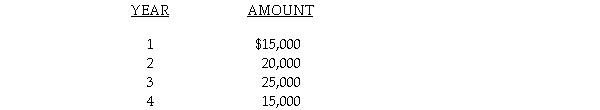

A capital investment project requires an investment of $50,000 and has an expected life of four years. Annual cash flows at the end of each year are expected to be as follows:  a. Compute the payback period assuming that the cash flows occur evenly throughout the year.

a. Compute the payback period assuming that the cash flows occur evenly throughout the year.

b. Determine the accounting rate of return for the project based on the initial investment.

c. Compute the net present value of the project using a 10% discount rate. (Round amounts to dollars.)

Correct Answer:

Verified

Q105: Lawton Co. is evaluating a project that

Q106: WN Company manufactures high quality Wagnuts. It

Q108: Depreciation deductions and similar deductions that protect

Q109: Boric Company is considering the purchase of

Q111: DOCA Corp. is considering the following two

Q112: The Quast Company is considering a capital

Q113: A capital investment project requires an investment

Q115: Tex Corporation trades in a class 10

Q146: Quoted market interest rate that includes an

Q150: The decline in the general purchasing power

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents