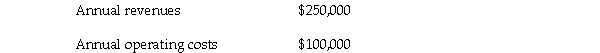

Lawton Co. is evaluating a project that requires an investment of $400,000. The company plans to dispose of the property at the end of the fourth year for $121,620. Information about cash flows associated with the project is as follows:  All cash flows occur at the end of the year. The required rate of return is 12% and the tax rate is 40%. The CCA rate is 30%.

All cash flows occur at the end of the year. The required rate of return is 12% and the tax rate is 40%. The CCA rate is 30%.

Determine the net present value of the project. (Round amounts to dollars.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Allowable depreciation under the income tax act

Q101: The Serena Company is evaluating two mutually

Q102: The annual income statement of ZAP Inc.

Q103: Cedric Inc. is considering two mutually exclusive

Q104: The owner of a construction company is

Q106: WN Company manufactures high quality Wagnuts. It

Q108: Depreciation deductions and similar deductions that protect

Q109: Boric Company is considering the purchase of

Q110: A capital investment project requires an investment

Q150: The decline in the general purchasing power

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents