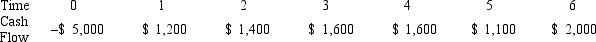

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

A) NPV = $1,766.55; accept the project

B) NPV = $892.19; accept the project

C) NPV = $1,288.94; accept the project

D) NPV = −$104.73; reject the project

Correct Answer:

Verified

Q75: Suppose your firm is considering investing in

Q76: Suppose your firm is considering investing in

Q77: Compute the PI statistic for Project Z

Q78: Suppose your firm is considering investing in

Q79: Compute the MIRR statistic for Project I

Q86: Suppose you have a project whose discounted

Q89: Under what conditions can a rate-based statistic

Q96: All of the following capital budgeting tools

Q98: All of the following capital budgeting tools

Q105: Which of the following best describes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents