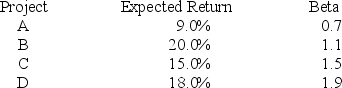

An all-equity firm is considering the projects shown as follows.  The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s) will be incorrectly accepted?

The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s) will be incorrectly accepted?

A) Project A

B) Project C

C) Project D

D) Projects C and D

Correct Answer:

Verified

Q50: Suppose that Wave Runners' common shares sell

Q61: FarCry Industries, a maker of telecommunications equipment,

Q62: An all-equity firm is considering the projects

Q68: An all-equity firm is considering the projects

Q70: Johnny Cake Ltd. has 10 million shares

Q71: FarCry Industries, a maker of telecommunications equipment,

Q75: Diddy Corp. stock has a beta of

Q76: KatyDid Clothes has a $150 million ($1,000

Q80: OMG Inc. has 4 million shares of

Q80: JLP Industries has 6.5 million shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents