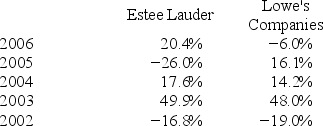

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return,standard deviation,and coefficient of variation.

Compute each stock's average return,standard deviation,and coefficient of variation.

A) Estee Lauder: 9.02 percent; 17.99 percent; 2.00 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

B) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

C) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 25.46 percent; 2.39

D) Estee Lauder: 10.7 percent; 17.79 percent; 1.66 and Lowe's Companies: 12.64 percent; 18.99 percent; 1.50

Correct Answer:

Verified

Q61: The past five monthly returns for PG&E

Q64: You have $10,000 to invest. You want

Q70: Consider the characteristics of the following three

Q72: Which of the following statements is correct

Q74: Compute the standard deviation of Kohl's monthly

Q76: Consider the risk-return relationship in T-bills during

Q77: Year-to-date, Oracle had earned a 15.0 percent

Q77: Which of the following statements is correct?

A)

Q79: Which of the following is correct regarding

Q80: Jane Adams invests all her money in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents