Toyworld Manufactures and Sells a Line of Toys Required:

A)Your Assistant Has Requested You to Complete the "Flexible

Toyworld manufactures and sells a line of toys.The toys are primarily distributed through department stores.As president of Toyworld,you wanted to analyze Toyworld's profitability.Your capable assistant provided you with the following data:

Required:

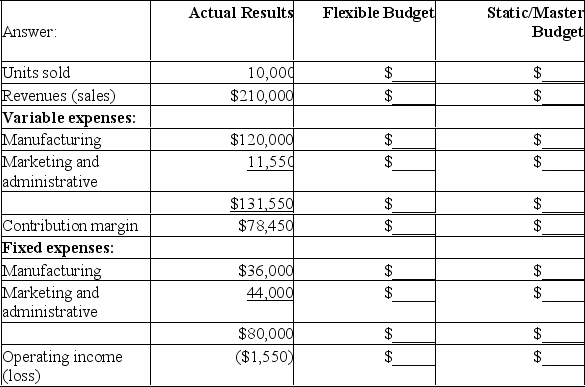

a)Your assistant has requested you to complete the "Flexible Budget" and "Static/Master Budget" columns of the analysis,reproduced below (She had to attend to an out-of-town emergency):

b)Calculate the following variances: flexible budget variance,sales volume variance,and total static budget variance.

Correct Answer:

Verified

Flexible...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: The participative budget can be a very

Q119: A flexible budget is "flexible" in the

Q120: The direct materials to be purchased for

Q121: In a not-for-profit entity a budget can

Q122: A sales budget is given below

Q124: Tilson Company has projected sales and

Q125: Montero Corporation,a merchandising company,has provided the

Q126: TabComp Inc.is a retail distributor for

Q127: Budgeting aids planning and controlling the level

Q128: The static budget is a good tool

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents