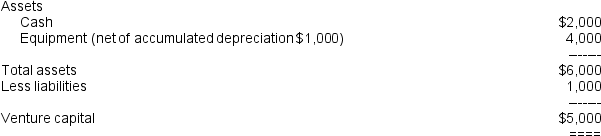

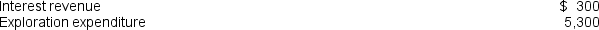

In July 20X6,Midstream Ltd entered into a joint venture operation with Delta Ltd to explore for minerals in the area of interest KP97.Midstream Ltd contributed $5,000,000 in cash and Delta Ltd contributed specialised drilling equipment with an agreed fair value of $5,000,000.The venturers shared control of the operation.All the assets of the operation were held by the venturers as tenants in common.The estimated useful life of the plant was 5 years.In the accounts of Delta Ltd,this equipment was carried at cost $6,000,000 less accumulated depreciation $3,000,000.For the year ended June 30 20X7,the following financial statements were prepared by the joint venture manager (amounts in thousands) : Balance Sheet as at June 30 20X7 Performance Statement for the Year ended June 30 20X7

Performance Statement for the Year ended June 30 20X7 At June 30 20X7,the exploration had not yet advanced to the stage where a reliable estimate could be made of the recoverable mineral reserves in KP97.

At June 30 20X7,the exploration had not yet advanced to the stage where a reliable estimate could be made of the recoverable mineral reserves in KP97.

The journal entry to record the initial investment of Midstream Ltd would be:

A) Debit Investment in Joint Venture $5,000,000 and Credit Cash $5,000,000.

B) Debit Cash $2,500,000, Debit Plant and Equipment $2,500,000 and Credit Cash $5,000,000.

C) Debit Investment in Joint Venture $2,500,000, Debit Plant and Equipment $2,500,000 and Credit Cash $5,000,000.

D) None of the above.

Correct Answer:

Verified

Q1: On September 30 20X7,Auction Ltd acquired a

Q2: The essential element which would distinguish the

Q3: Accounting Standard AASB131 Interests in Joint Ventures

Q5: On July 1 20X4,Gold Ltd formed a

Q6: At the reporting date,June 30 20X7,the effect

Q7: The journal entry to record the initial

Q8: Midstream Ltd and Delta Ltd enter into

Q10: A venture must recognise its interest in

Q11: Midstream Ltd and Delta Ltd enter into

Q15: A jointly controlled entity can be:

A) a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents