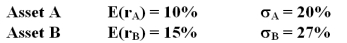

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%:  An investor with a risk aversion of A = 3 would find that _________________ on a risk return basis.

An investor with a risk aversion of A = 3 would find that _________________ on a risk return basis.

A) only Asset A is acceptable

B) only Asset B is acceptable

C) neither Asset A nor Asset B is acceptable

D) both Asset A and Asset B are acceptable

Correct Answer:

Verified

Q45: The holding-period return on a stock was

Q49: You have $500,000 available to invest. The

Q50: Consider a treasury bill with a rate

Q51: You invest $1,000 in a complete portfolio.

Q52: Most studies indicate that investors' risk aversion

Q53: The holding period return on a stock

Q54: You invest $1,000 in a complete portfolio.

Q56: You invest $1,000 in a complete portfolio.

Q57: Consider the following two investment alternatives.First,a risky

Q60: The formula ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents