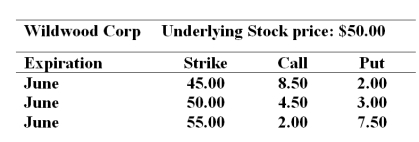

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

-To establish a bull money spread with puts you would _______________.

A) sell the 55 put and buy the 45 put

B) buy the 45 put and buy the 55 put

C) buy the 55 put and sell the 45 put

D) sell the 45 put and sell the 55 put

Correct Answer:

Verified

Q34: An American call option gives the buyer

Q39: The Option Clearing Corporation is owned by

Q40: Which one of the statements about margin

Q41: A put on Sanders stock with a

Q42: An option with a payoff that depends

Q47: You buy one Hewlett Packard August 50

Q48: A down-and-out option is one type of

Q49: A "bet" option is also called a

Q54: The potential loss for a writer of

Q59: Buyers of listed options _ required to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents