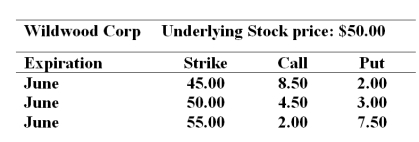

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

-Suppose you establish a bullish money spread with the puts.In June the stock's price turns out to be $52.Ignoring commissions the net profit on your position is __.

A) $500

B) $700

C) $200

D) $250

Correct Answer:

Verified

Q62: If you combine a long stock position

Q75: What strategy could be considered insurance for

Q76: An investor is bearish on a particular

Q77: The common stock of the Avalon Corporation

Q78: Which of the following strategies makes a

Q81: Warrants differ from listed options in that

Q82: You find digital option quotes on jobless

Q84: You own $75,000 worth of stock and

Q85: You sell one IBM July 90 call

Q87: You own a stock portfolio worth $50,000.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents