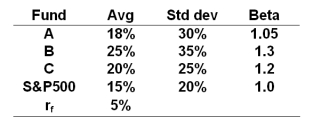

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

-If these portfolios are subcomponents which make up part of a well diversified portfolio then portfolio ______ is preferred.

A) A

B) B

C) C

D) S&P500

Correct Answer:

Verified

Q13: Suppose that over the same time period

Q14: The average returns, standard deviations and betas

Q15: Henriksson found that,on average,betas of funds _

Q16: A mutual fund with a beta of

Q17: The risk free rate, average returns, standard

Q19: The risk free rate, average returns, standard

Q20: The M2 measure is a variant of

Q21: In the Treynor-Black model security analysts _.

A)

Q22: In a particular year, Lost Hope Mutual

Q23: In a particular year, Salmon Arm Mutual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents