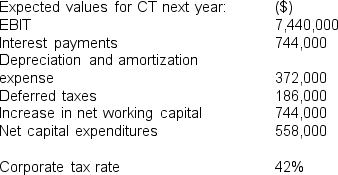

Third Cup is considering purchasing Canadian Tea Inc.(CT).Third Cup,a high-end food and beverage retailer,has been provided with the following information for Canadian Tea,for the next year.

Third Cup has asked you to conduct the following analysis:

A) Estimate Canadian Tea's free cash flow to equity for next year.

B) Estimate the total value of Canadian Tea's equity, as well as on a per-share basis. Assume (i) a constant annual growth rate of free cash flow of 4.3% indefinitely, (ii) Canadian Tea has 650,000 shares outstanding, (iii) the appropriate beta is 1.12, (iv) the expected market return is 9.8 percent, and (v) the risk-free rate is 3.6 percent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: List and briefly describe five possible sources

Q68: For acquisitions, which purchaser type values the

Q78: Define synergy and explain what effect it

Q82: Sinatra Inc.,a privately owned company,has 2015 after-tax

Q83: You are a shareholder of a publicly

Q84: An acquiring firm is considering buying Toronto

Q84: List and briefly describe three defense strategies

Q86: Beta Corporation is a manufacturing firm that

Q87: What is a tender offer?

Q88: What would be the motivation behind protecting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents