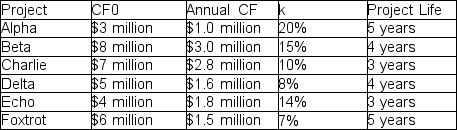

Suppose a company has the following information on six independent projects:

A) Find the IRRs of the six projects.

B) Which projects should the company undertake if it has no capital constraints? Why?

C) What is the impact on the company's shareholder value in (b)?

D) Which projects should the company undertake if it has a capital constraint of $15 million? Why?

E) What is the loss to the company from the capital rationing constraint in (d)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: The MIRR method is better than the

Q126: In a capital rationing situation, should firms

Q127: What improvement does MIRR represent over traditional

Q133: What is a project's NPV if it

Q135: Michael Porter argues that firms can create

Q136: In project valuation,one should accept the project

Q137: Project X has a project with cost

Q139: When a business faces capital rationing,what discount

Q142: Project X has a cost of capital

Q143: The Spinning Politician Company is considering three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents