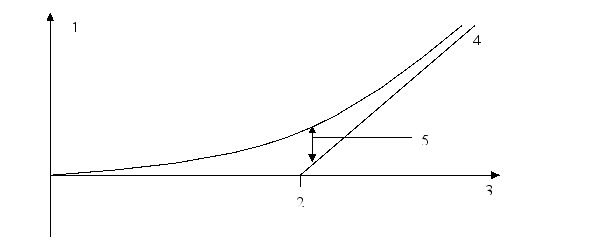

Label the diagram below:

Time Value

Underlying asset price

Strike price

Intrinsic value of a call

Payoff/profit/option value

A) 1, 2, 3, 4, 5 respectively

B) 5, 3, 2, 4, 1 respectively

C) 4, 1, 2, 5, 3 respectively

D) 5, 1, 2, 4, 3 respectively

Correct Answer:

Verified

Q1: The difference between the intrinsic value of

Q5: What is a short position?

A)Position taken by

Q6: Which of the following statements is NOT

Q10: Which of the following investors would be

Q10: Which of the following statements is true?

A)An

Q12: Which of the following is the higher

Q14: A call option is:

A)the right to buy

Q16: Jay writes a call option with a

Q18: If an investor is trying to cancel

Q20: An option can be:

I.in the money

II.out of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents