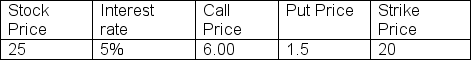

Consider the following information about a three-month option on stock XYZ:

Using the information above,calculate the arbitrage profit:

A) $0

B) $0.75

C) $1.45

D) $4.19

Correct Answer:

Verified

Q24: When can put-call parity be applied?

I.Call and

Q34: Min has created the following portfolio:

bought a

Q34: The standard Black-Scholes option pricing model assumes:

A)European

Q35: Put-call parity can be used to assess:

A)

Q36: Use the following statements to answer the

Q37: _is the relationship between the price of

Q38: The basic put-call parity can be rearranged

Q39: Which of the following strategies does NOT

Q40: Given: S = $55,X = $50,r =

Q41: Which of the following is correct ?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents